Bookkeeping

The best service for your accounting!Bookkeeping doesn’t equal bookkeeping. A well organised and up to date bookkeeping is necessary for a successful company nowadays. We use modern technology that ensures highest efficiency and productivity. We support you to maintain an overview to take sure decisions and to react quickly on changes.

In addition to the minimum statutory requirements we offer a range of additional services to our clients. The aim of those services is to generate more value for you and your Company.

In addition we offer a complete outsourcing of your accounting so that your company can fulfill its obligations in time, regardless of skills shortage, sick leaves, or other personnel issues.

Document entry

✓ Booking of all receipts monthly or quarterly

✓ Fulfillment of legal recording duties

✓ Check of receipts

Digital bookkeeping

✓ Safekeeping of all date for 7 years (statutory period)

✓ Connection to bank accounts (upon request)

✓ Use a local or online cash book (upon request)

✓ Entry of your receipts from your invoicing program (upon request)

Reports to tax authorities

✓ Preparation and transmission of turnover tax advance return recapitulative Statement

✓ Continuous VAT testing

✓ On time information about level of payments or credit

Selected operations reviews

✓ Specific analysis about your company for better overview (balance list, short-term success list) compared to last year

✓ Every important information at a glance

✓ Graphically supported clear reports

✓ Managing of open items (customers and suppliers)

Administration

✓ Full communication (customer, tax authority, bank …)

✓ Monitoring and booking of your tax account / account Information

✓ Active monitoring of your tax prepayments

✓ Repayment and transfer of tax payment applications

Continuous support

✓ The solutions to your little questions from the accounting

✓ Quickly answered via telephone or mail

Charging: lump-sum or based on time and material

The lump-sum is fixed for one year and assures you full cost control.

Additional packages

Enhanced benefits for you and your company

- Your customers will be reminded on bills not paid yet

- You decide which customers will be reminded (reminder list, individual text including your logo, dispatch auf dunnings)

- Booking of all bills at your given date or interval (e.g. weekly)

- You don’t have to manage a separate unsettled invoices account

- Clear reduction of unsettled invoices

- ABC-analysis of customers/suppliers

- Current payments are posted upfront in your online-banking system

- You authorise payments

- No additional booking necessary

- Cash-management support

- You benefit from a detailed supplier master data process

- Booking of all invoiced at given intervals (e.g. weekly)

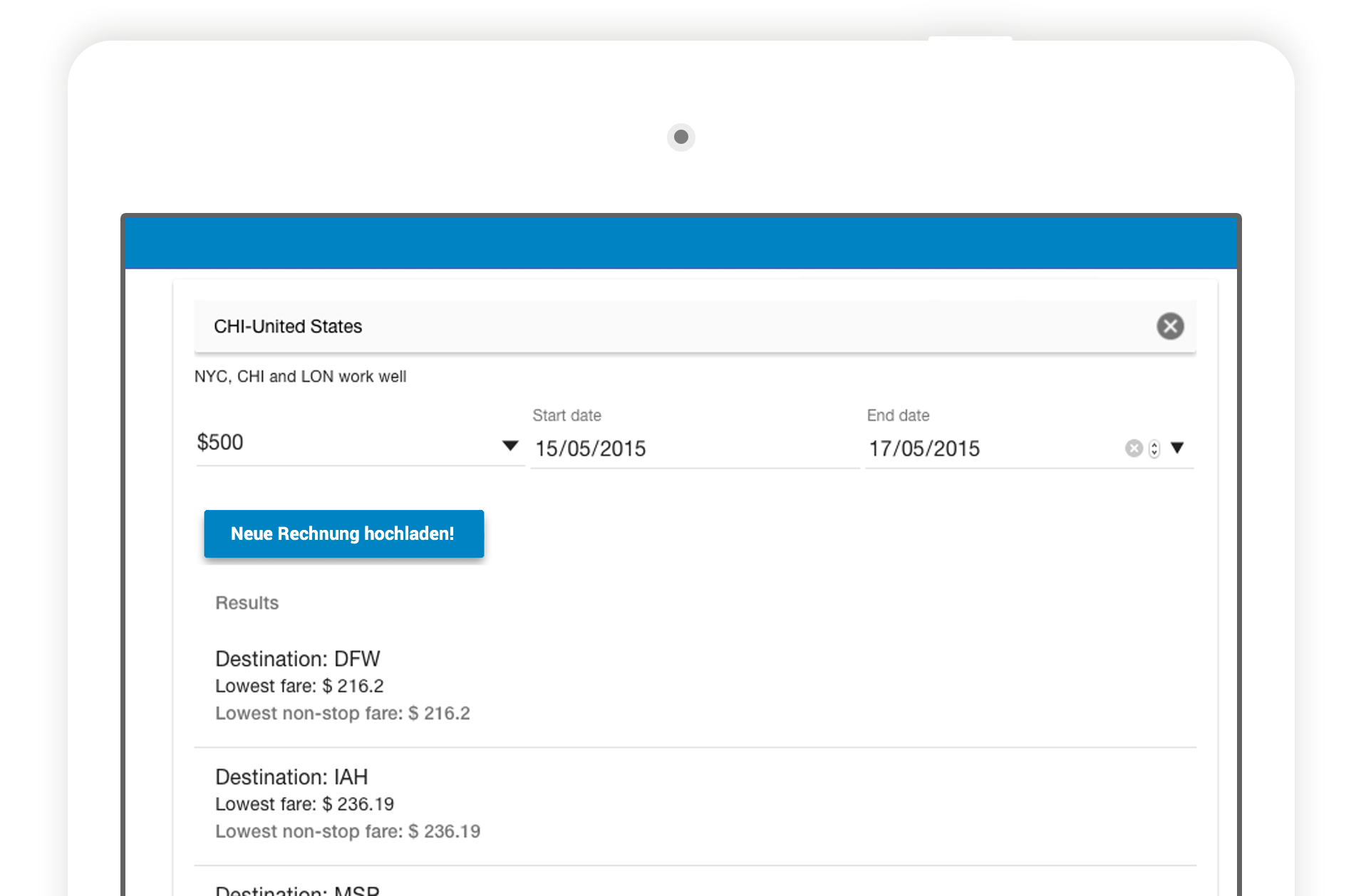

- All invoices are stored electronically

- No sending, no long-term storage

- Access your invoice from everywhere anytime

- Audit-proof archive

- New: access via smartphone-app from nowadays

- Determination of a budget at the beginning of a fiscal year

- Continuous target-actual comparison

- Clear and graphically prepared reports (including a comparison to last year)

- Tailored extrapolation before end of fiscal year

- Management of a detailed cost account

- Cost center and cost unit accounting

- Detailed analysis by profit centers and / or cost centers

- Provisioning of internal cost allocations upon request

- Automatic collection and editing of invoices

- Definable workflow for audit and approval by responsible employee

- Significant reduction of processing time as well as process optimization

- On site bookkeeping

- Amortization, accruals and inventory changes before end of fiscal year

- Monitoring of UID-Numbers level 2 (see respective blog entry)

- ABC-analysis of customers/suppliers

- Individual management information with defined key figures and charts

- Periodical controlling reviews (monthly, quarterly)

- Gross supplement Calculation and test of margins

- Execution of insurance and statistical notifications

- Express-service, sorting-service, pick-up and delivery-service

- Analysis and Communication in English

- Handling of excise taxes

- Export of data to be used in other systems

Electronic document archive

With our electronic document archive you are able to upload all your receipts and discard them. With that there’s no need to keep old wrinkled receipts for several years. Search quickly and efficiently through your electronic documents. You have access from everywhere and anytime – including your smartphone. Benefit from an audit-proof electronic document archive that is recognized by tax authorities too.